The Cause of the Digital Downturn

The electronics industry is experiencing a downturn, but according to experts, this slump started much earlier in 2021. We take a look at the reasons for this decline despite technology's fast-paced evolution all over the world.

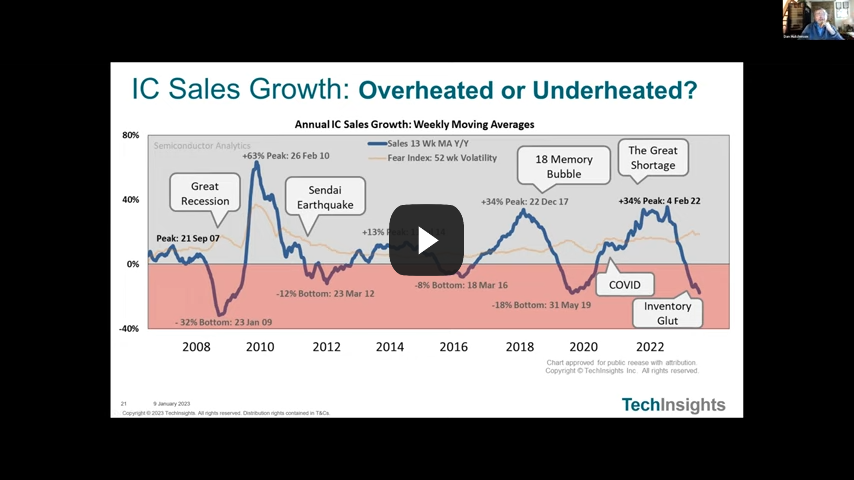

Smartphones have become necessities for work and personal use, meaning their demand should be high and steady. However, according to the International Data Corporation (IDC), the smartphone market has declined since the COVID-19 outbreak in 2020. In fact, smartphone deliveries have dropped to a decade-long all-time low of 269 million units. IDC predicts that it will further decrease by 3%. Tech market analyst Canalys further states that as of 2023's second quarter, smartphone sales have decreased by 11%.

This scenario is the same for personal computers (PCs). Though it experienced a surge of almost 60% in 2020 due to increased remote work and virtual interactions, it steadily subsided, reaching a low of -29% in the first quarter of 2023.

Reasons for the decline

Why is the electronics industry suffering? Though lockdowns and social restrictions have mostly been lifted worldwide, countries still feel COVID-19's long-term effects, filtering down to various sectors, including electronics. Here are some reasons why this is happening.

- Global economic recession

According to the International Monetary Fund (IMF), the global economy is expected to be sluggish in 2023. Developed economies will sharply feel the crunch, decreasing from 2.7% in 2022 to 1.2 this year. Furthermore, 90% of first-world economies are likely to slow down.

The US economy will decelerate by 1.4% due to the Federal Reserve's increased rates. Though the EU shows promise with its successful energy crisis management, solid financial help, and a not-so-harsh winter, trade situations have worsened because of the European Central Bank's strict monetary policies. Adding to the problem is the rising energy costs, resulting in low growth at 0.7%.

Meanwhile, emerging economies have collectively reached their lowest growth point but are predicted to grow by 4% this year.

Still, China and India will experience a boost this year, with both countries comprising 50% of this year's global growth.

- Russia-Ukraine dispute

Both countries are the main sources of neon, palladium, nickel, platinum and other raw materials essential for semiconductor manufacturing. But, the conflict has disrupted shipments of these supplies, also affecting supply chains. This further burdens an industry still grappling with the repercussions of the COVID-19 pandemic.

- US curbs on China's chip tech access

Last October 2022, the US implemented stringent export guidelines that limited China's acquisition of computer chips and chip-making equipment to manage Beijing's weapon-manufacturing technology. Measures imposed by the Biden administration include preventing US companies from providing advanced chip-manufacturing equipment to China without obtaining a license.

- A significant drop in device demand

Due to the economic downturn, consumers cling to their phones longer than usual. Other reasons for the low smartphone turnover are the lack of significant technology and inflation—especially now that suppliers are transferring the increased costs of components to customers.

Also read: IMI Sustains Continued Growth Despite Industry-wide Macroeconomic Issues

A look at the global electronics manufacturing scenario

The S&P Global Electronics Purchasing Managers' Index (PMI) results from feedback gathered from procurement managers working in electronics manufacturing across the globe. The PMI is a combined score of various indices that monitor new orders, production, workforce, supplier delivery times, and purchase inventory.

Here are some key points from the report:

- Both fresh orders and produced goods fell at their quickest in June 2023 since the start of the year due to poor demand and inflation.

- Sluggish rise in employment in the electronics sector, but increased hiring activity is because of vacant positions due to resignations.

- Boosted selling prices are because of raw material and energy expenses.

- Because fewer customers are ordering, there are no more backlogs for previous orders.

- All-high inventory of finished goods in ten months due to unsold products.

South Korea

Samsung Electronics and SK Hynix dominate South Korea's dynamic random-access memory industry. However, these electronic giants will likely face financial difficulties because of reduced memory prices. The good news is that prices may rise again later this year, fully recovering in 2024. Overall, the country's electronics production has been erratic. After achieving growth in the double digits in the latter part of 2022, it significantly dropped to 12.4% last May.

Japan

Things are looking up for Japan, which recovered from a lackluster performance in 2022, showing a 3-month average boost of 8.4% last April. While gadget demand is on a downturn, Japanese chipmaker Renesas Electronics Corporation is thriving because of the consistent demand from automakers.

Vietnam

Vietnam is trying to regain its footing, displaying robust growth in 2022 but dropping to negative figures in February this year. Still, its electronic sector's drop of almost 11% in May improved to nearly 8% in June.

China

Last May, China's exports shrank faster than expected, with imports continuing to decrease, especially from developed markets. Considered the second-largest global economy, China experienced a surge during the first quarter as it fulfilled orders put on hold by COVID-19. However, manufacturing production has slowed because of inflation and increased interest rates. To remedy this, the government hopes to boost domestic demand.

Taiwan

The US and China continue to decrease their demand for Taiwan's tech offerings, resulting in its worst export slump in over a decade. Last June, Taiwan's finance ministry announced that its export value has been on a downtrend over the previous ten months.

While electric parts and semiconductor components plunged 21% and 20%, the ministry stated that its previous recovery projection by September may be moved to November this year.

As of June, Taiwan's exports to China fell 22%, which is worse than May's decline of 19%.

Road to recovery

Though figures are grim, experts are optimistic about recovery, albeit slow, in 2024. Proof of the improving scenario is the UK's production growth, which has sustained 8% to 11% beyond the first quarter of 2023. Meanwhile, experts predict that US GDP will experience an upswing of a good enough 0.6% in the fourth quarter. The AI boom will likely fuel the electronics sector—just don't expect it to happen this year.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog