The Future of China’s Industrial Strength

China’s overproduction is sparking global concerns. And it’s no surprise—China contributes a significant share of the total value generated by global manufacturing and one-fifth of all industrial exports. However, some experts think a downturn in China’s manufacturing sector may be approaching.

The current export share of China's gross domestic product (GDP) stands at 33%, significantly lower than the 64% peak recorded in 2006. This decline is noteworthy, especially since China’s export proportion is now below the global average, raising important questions about the country's economic dynamics.

However, the manufacturing giant is far from losing its grasp on the global industrial market. McKinsey states that China remains a key player in the world’s supply chain management, with its value share growing to 34% in 2023, an increase from 19% in 2010. Additionally, China is enhancing its industrial supply chain, making domestic procurement increasingly beneficial for operators. This development provides more choices for operational strategies and flexible trade plans.

China's industrial manufacturing is projected to improve, bolstered by a rebound in exports and fresh orders. Still, persistent challenges in China's local economy may impact its year-on-year production growth. For instance, its domestic market recovery has remained slow, resulting in heightened competition. Deflationary pressures have persisted, while pricing factors may continue hindering growth in manufacturing capabilities. In April 2024, China’s Producer Price Index (PPI) declined by over 2% year-on-year for 13 consecutive months, according to recent manufacturing industry news.

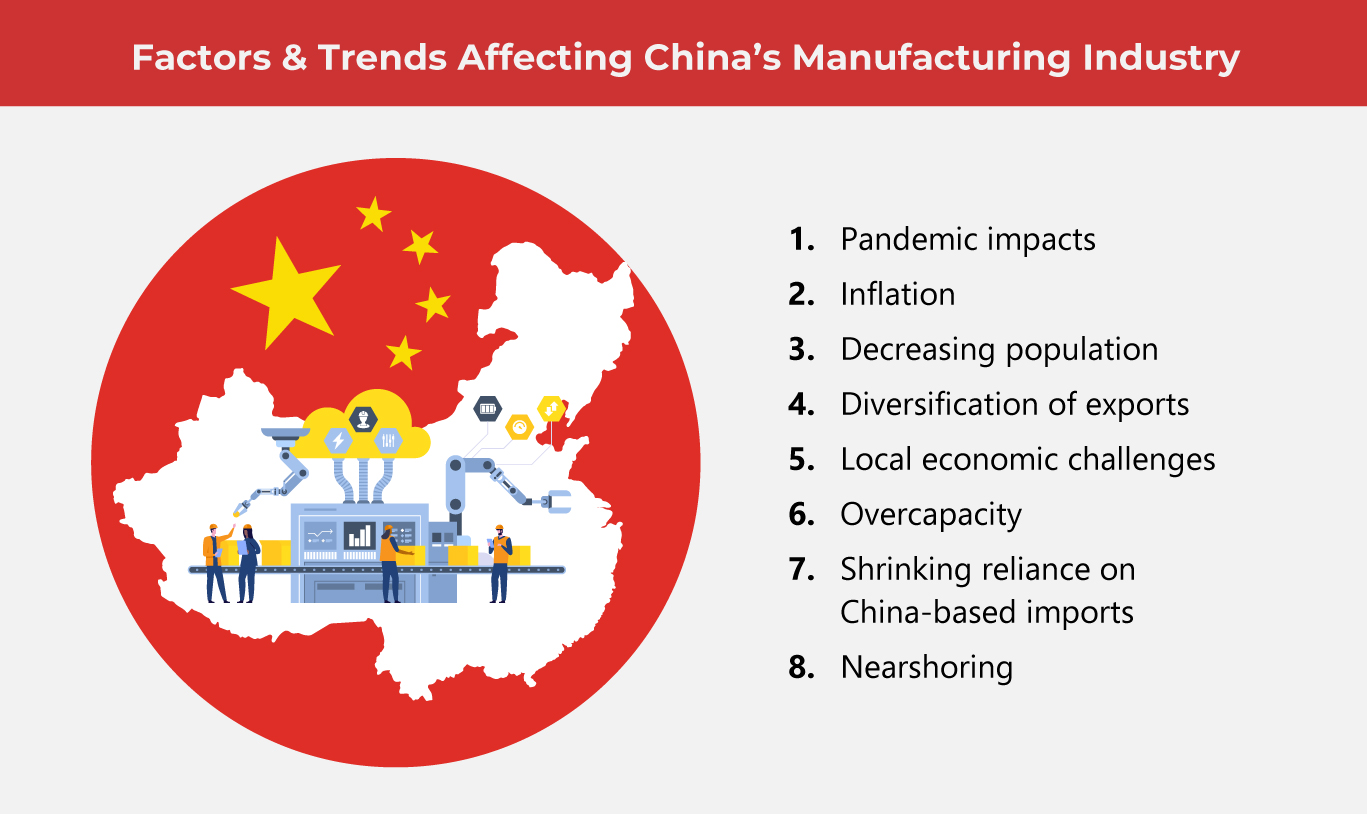

Top 8 trends affecting China’s manufacturing industries

While China’s production is struggling, it hasn’t always been this way. For decades, China has been the world’s leading manufacturer, ascending to unmatched status in the 1990s. As the country adapts, several driving factors surface.

-

Pandemic impacts

China’s “Zero COVID” policy left lasting impacts on its industrial sector, driving companies to reconsider operations there. Prolonged lockdowns, widespread testing, and rigid restrictions hindered growth, with industrial output dropping by 2.9%, retail sales by 11.1%, and export growth slowing to 3.9%. Companies like Apple began exploring alternatives, signaling a potential shift away from China.

-

Inflation

Inflation has eroded the cost benefits that once attracted U.S. manufacturers to outsource to China. Surging material costs, unpredictable wages, higher shipping fees, and increased import duties have elevated producer prices. Facing these growing expenses, many U.S. companies are now considering alternatives like nearshoring to Mexico as a more viable production strategy.

-

Decreasing population

China’s family-planning policies have left a lasting economic impact. Typically, household disposable income supports 60 to 70% of GDP, yet China's one-child policy reduced earnings and domestic demand. Now, China’s population is declining and aging rapidly, with a shrinking labor force. This trend challenges global manufacturing companies with rising wages, costs, and reduced productivity.

-

Diversification of exports

China’s export landscape has transformed, increasingly focused on knowledge-intensive products over traditional, labor-intensive ones. The automobile industry’s market shares, along with electronics and advanced machinery, have steadily expanded. Meanwhile, exports of low-value goods like apparel and toys have declined. In 2024, China’s electric vehicle exports are projected to continue growing, though demand cycles and tariffs may temper this pace.

-

Local economic challenges

China’s manufacturing sector faces challenges from sluggish consumer spending, a weak property market, and dampened confidence. Real estate-driven savings have curbed spending, while fierce competition limits international expansion. Despite government efforts to stimulate growth, concerns persist over weak demand and economic recovery, especially in non-metallic minerals and off-highway vehicles, as global uncertainties weigh on China’s manufacturing outlook.

-

Overcapacity

World leaders are criticizing China for overcapacity in the automotive market, which threatens tariffs on electric vehicles. While China proposed non-binding measures to curb battery industry expansion, concerns about state support for key industries persist. Weak domestic demand exacerbates overcapacity issues, as companies grapple with low utilization rates, high inventories, and pressure to increase exports, particularly in clean energy sectors.

-

Shrinking reliance on China-based imports

The U.S. separation from the Chinese supply chain is significantly affecting China's manufacturing sector, prompting several companies to move or replicate their operations in other countries. The backlash against China, stemming from Trump’s tariffs and intensified under Biden, has significantly reduced the share of Chinese goods in U.S. imports. As American companies seek manufacturing solutions abroad, some Chinese firms are shifting production to countries like Vietnam and Mexico.

-

Nearshoring

Businesses strive for manufacturing excellence by reducing dependence on far-off production locations. Companies are relocating operations closer to key markets, especially in Southeast Asia and Latin America, to boost supply chain resilience, lower shipping costs, and improve responsiveness to market demands, ultimately impacting China's competitive edge in manufacturing.

Where China stands in global manufacturing

China's influence in the global manufacturing sector is still significant. As the global economy evolves, China is shifting its focus toward exporting innovative technologies and diversifying its trading partners. While still the largest trading economy and exporter worldwide, its role has transformed.

The trade landscape has changed, with the Association of Southeast Asian Nations (ASEAN) gaining importance as a trading partner, reflecting a gradual shift in dynamics. However, there may still be a modest year-on-year growth in China’s manufacturing output, driven primarily by a recovery in the semiconductor industry as global demand rebounds. The electronics and electrical equipment sector also shows promising growth, buoyed by expected increases in export demand.

Moreover, the machinery segment is anticipated to outpace end-products manufacturing, as improved capacity utilization encourages investments in production efficiency. However, the rise of China's services sector could challenge manufacturing, as the government aims to increase household disposable income. This shift is expected to boost Chinese demand for US goods while providing employment opportunities for the growing number of college graduates in service industries, further reshaping the manufacturing landscape.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog