Trump vs. Taiwan: Who Will Win the Chip Battle

Donald Trump has reignited criticism toward Taiwan, claiming it has taken over the U.S. semiconductor industry. In response, Taiwan's leading tech official pushed back, stressing that chip production relies on global teamwork—not dominance. As tensions rise, questions loom over whether this rhetoric could strain U.S.-Taiwan relations.

President Donald Trump has revived an old narrative, accusing Taiwan of dominating the U.S. chip sector and pledging to bring semiconductor production back to American soil.

In a Bloomberg interview late last year, he claimed Taiwan had taken “almost 100%” of the global chip manufacturing industry—a move he believes the U.S. never should have allowed. His remarks have again thrust Taiwan’s pivotal tech role into the spotlight, fueling debate over domestic manufacturing and international supply chain management.

Taiwan’s top technology official, Wu Cheng-wen, responded to President Trump's renewed criticism of Taiwan's dominance in the semiconductor industry. Wu, the Minister of Taiwan's National Science and Technology Council, emphasized that the semiconductor sector is inherently global and thrives on international collaboration rather than control by a single nation.

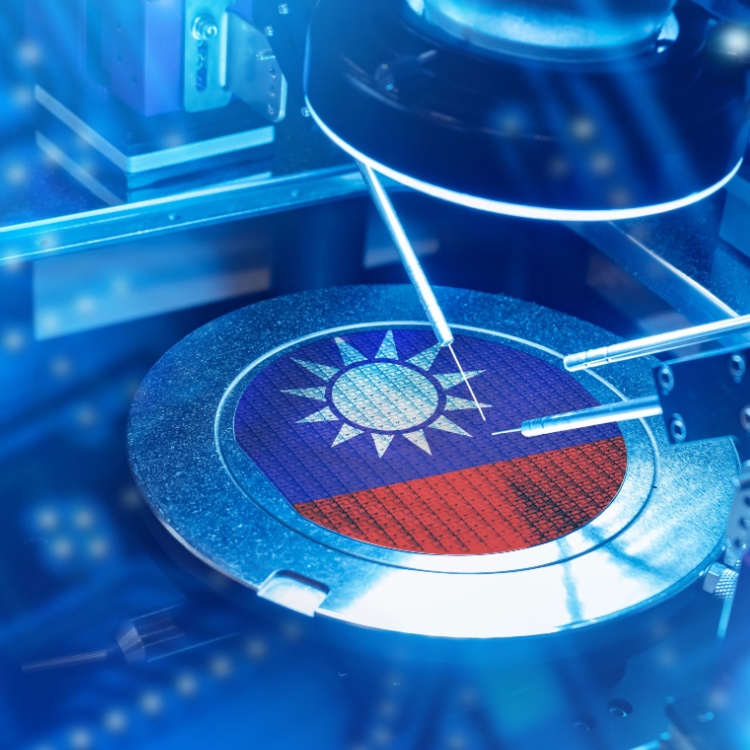

He highlighted Taiwan's decades-long investment and development in the industry, including the establishment of TSMC (Taiwan Semiconductor Manufacturing Company) in 1987, now the world's largest contract chipmaker. Wu asserted that Taiwan's success stems from sustained effort and innovation, not by taking from others.

He added that each country plays a unique role in the semiconductor industry, with Japan excelling in chemicals and equipment, and the U.S. leading in design and innovation. Taiwan, he said, is ready to support democratic nations in their roles within the semiconductor supply chain.

Taiwan’s chip supremacy

TSMC produces 90% of the world’s top semiconductors, including those in Apple and Nvidia products.

Still, there’s little evidence to back Trump’s claim that Taiwan took what was rightfully the U.S.'s. Companies like TSMC rose to prominence through innovation, research, and unmatched efficiency, packing more transistors into smaller chips than their rivals.

In Taiwan, the workforce is highly educated, and semiconductor jobs are well-paying. Working at TSMC or a similar company is seen as a prestigious career with great prospects.

Taiwan's semiconductor industry has developed over the past 30 to 40 years, making it challenging to replicate, according to Su Chen-kang, Deputy Minister of the National Science and Technology Council (NSTC).

He emphasized that it’s the government's role to ensure the semiconductor industry stays competitive. He also pointed out that Taiwan’s strength comes from its entire industry ecosystem, not just individual companies. To maximize this, Taiwan works closely with supply chains from Europe, the U.S., and Japan.

As other nations strive to catch up, Taiwan's lead in semiconductor manufacturing continues to expand. A TrendForce report indicates that Taiwan Semiconductor Manufacturing Company (TSMC) increased its market share to 67.1% in late 2024, widening the gap with its closest competitor, Samsung, to 59 percentage points.

Meanwhile, a study by the China Strategic Risks Institute warns that a disruption in Taiwan's semiconductor output could result in up to $2.5 trillion in annual global economic losses, highlighting the critical importance of Taiwan's role in the tech ecosystem.

Taiwan’s grip on the world’s most advanced chips has sparked growing concern over the vulnerability of global supply chains—especially in the event of conflict with China.

The COVID-19 pandemic already offered a preview: when factories shut down, the resulting chip shortage disrupted global production and pushed up prices for everything from the automotive market to electronics manufacturing.

US-Taiwan relations

The U.S. and Taiwan have worked to restrict China’s access to advanced tech, focusing on semiconductors. Biden expanded Trump-era electronics export controls in 2022 and 2023, using the Foreign Direct Product Rule. As Biden’s term ended and Trump returned, two major updates strengthened these restrictions.

TSMC operates older chip facilities in China, but these plants remain several generations behind its most advanced technology and have U.S. approval to continue running. With Taiwan classified as a top-tier partner under U.S. export controls and TSMC receiving subsidies through the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act, expansion or significant upgrades in China-based manufacturing markets and technologies appear unlikely.

TSMC swiftly complied with U.S. blacklists by halting business with Huawei and other sanctioned firms. Despite this, the global chip shortage has kept demand for its services high.

As a result, the supplier’s quality and dominance in advanced manufacturing allowed TSMC to raise prices and hit record profits and market value.

According to Global Taiwan, most Taiwanese chipmakers, aside from TSMC, either produce tech that falls below U.S. export control limits or have been cleared to continue operations. As a result, exports to China have increased since the restrictions began. Some of this growth may stem from the Chinese industrial market stockpiling parts, but overall, Taiwan’s alignment with U.S. policy hasn’t seriously hurt its semiconductor industry.

Taiwan’s leadership in the semiconductor industry is viewed as a critical asset in terms of national security. Geopolitical analysts often describe the island’s semiconductor industry as a "silicon shield," serving as a key deterrent to Beijing’s ambitions, while encouraging global efforts to keep Taiwan outside China’s control.

When Trump made his remarks, Taiwanese officials reaffirmed the close ties between the U.S. and Taiwan, highlighting the global teamwork within Taiwan’s chip industry, which includes several international companies. At the same time, they made it clear that Taiwan plans to keep its product design, research, and development at home to protect its lead in the sector.

Taiwan recently eased rules that once required TSMC to keep its most advanced chip making at home, clearing the way for the company to outsource manufacturing of cutting-edge chips to other countries—aligning with U.S. efforts to boost domestic production.

Still, TSMC’s core R&D and leadership will stay rooted in Taiwan, and the company will remain under Taiwanese jurisdiction. By expanding production for U.S. tech firms, TSMC is widening its lead in the global market, making it even harder for American rivals like Intel to close the gap.

TSMC’s presence in the U.S.

A month after criticizing Taiwan’s chip industry, Trump announced that TSMC will invest an additional $100 billion to expand its U.S. chip manufacturing, building five advanced fabrication plants.

The new pledge, made during a White House event alongside TSMC CEO Che-Chia Wei, adds to the company’s previous $65 billion commitment under the Biden administration. Most of the funding will be directed toward Arizona, where TSMC already operates and began production in late 2024.

Trump hailed the move as a win for American jobs and tech security while signaling possible 25% tariffs on foreign-made chips to encourage domestic production. The announcement comes amid growing calls for TSMC to diversify away from Taiwan, given geopolitical tensions with China.

Taiwan's government acknowledged the deal but emphasized that the island must retain its lead in semiconductor technology. President Lai Ching-te's office said any overseas investments would be reviewed by law, ensuring Taiwan keeps the most advanced processes. Premier Cho Jung-tai echoed support for global cooperation but stressed safeguarding Taiwan's central role in the chip industry.

Wei said the expansion will boost production and economic value to meet surging demand in AI and smartphones, bringing TSMC’s total U.S. commitment to roughly $165 billion.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog