Tensions Rise as the US Raises Tariffs

In May 2024, U.S. President Biden increased tariffs on key products from China, such as semiconductor chips, EVs, batteries, solar cells, and critical minerals.

According to the White House Fact Sheet released on May 14, 2024, the United States Trade Representative was directed by President Joe Biden to raise tariffs under Section 301 of the Trade Act of 1974 on imports from China worth $18 billion.

(Also Read: This Chips War Is Just Getting Started)

The move was made to protect the interests of American businesses and workers against alleged China’s “unfair trade practices”.

Examples of some of these practices are China’s “forced technology transfer” and intellectual property theft. There has also been flooding in the global market of cheaper EVs. According to the White House, these practices have contributed to 70%-90% of global production for the critical inputs necessary for the U.S.’s technologies and infrastructures, posing risks to the U.S.’s supply chains and economic security.

What’s more, according to the White House Fact Sheet, these non-market practices contribute to China’s growing overcapacity and export surges, which can become harmful to American businesses and workers.

Which Products Are Impacted?

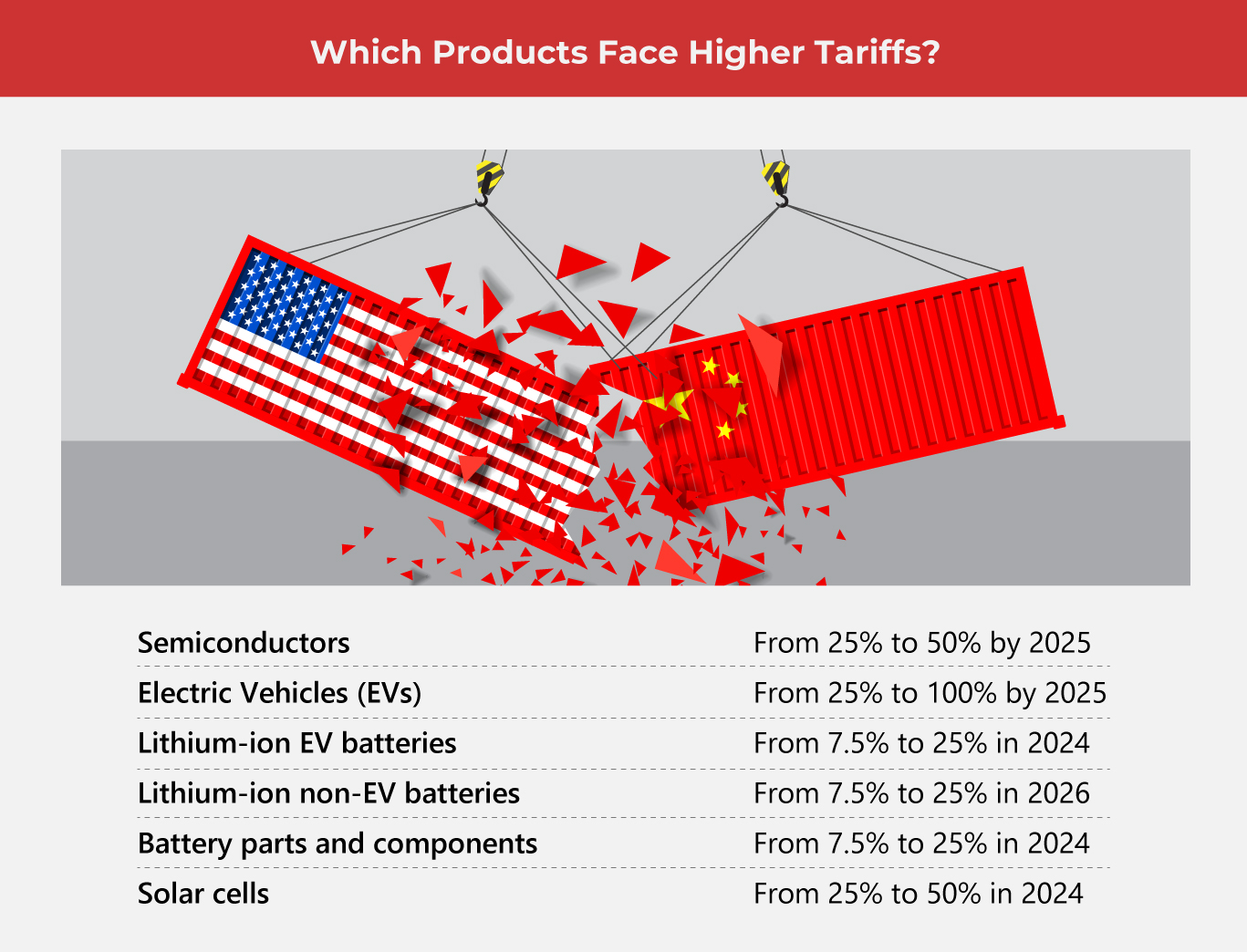

Strategic sectors such as semiconductor chips, EVs, batteries and battery components, solar cells, and critical minerals are only the tip of the iceberg. Also impacted are steel and aluminum, ship-to-shore cranes, and medical products. What’s getting the most attention are the aforementioned electronic components, EVs, and batteries, as the higher tariffs add tension to what is already a fraught dynamic between the U.S. and China. It was only October 2023 when the U.S. issued stricter sanctions for the export of semiconductor chips to China.

What’s getting the most attention are the aforementioned electronic components, EVs, and batteries, as the higher tariffs add tension to what is already a fraught dynamic between the U.S. and China. It was only October 2023 when the U.S. issued stricter sanctions for the export of semiconductor chips to China.

Now, with increased tariffs from 25% to 50% by 2025 for semiconductor chips, the screws have been tightened further.

Electric vehicles have also been a large chokepoint for the two countries, especially with cheaper China-produced EVs flooding the global market. Numbers from the White House Fact sheet show that China’s EV exports grew from 70% from 2022 to 2023, edging out investments from the U.S. This is mainly why the tariffs for EVs were raised to an astonishing 100% from 25%.

China Responds to the Tariff Increase

China vehemently opposes the tariff increase and vows to “take all necessary actions” in response. According to CNN, China warned that trade barriers such as this would “affect the wider relationship between the two economic superpowers”.

Where the U.S. seeks to protect the country’s business interests, China sees it as a “suppression of development”, potentially harming broader relationships and impacting cooperation between nations.

China’s Ministry of Commerce said to CNN that China “would take resolute measures to defend its rights and interests” and also urged U.S. President Biden to “correct his wrongdoing”.

Preparing for Impact

Many have weighed in on what they think the impact of increased tariffs on these products would mean for the U.S.

According to China Briefing, the 100% increase in tariffs for EVs is sure to “decimate” China’s foothold in the U.S. market, but American consumers will barely notice or be affected by it. The same may be said for the American EV industry as a whole since there would be a “low level” of competition from Chinese markets.

Meanwhile, the Center on Global Energy Policy at Columbia University scholars have also weighed in. Research scholar Tom Moerenhout does not find the 100% increase to be surprising. He projects that China will have a difficult time navigating the U.S. market, but will “likely continue to dominate the world market”. He predicts that China may take on a more defensive stance and tighten supply chains in the U.S. markets.

When it comes to semiconductor chips, China Briefing downplays China’s U.S. imports to be “a very small amount, standing at around 5.6% by import value in 2023.”

It also reasons that because the U.S. does not “have a heavy reliance on the import of critical minerals from China”, raising the tariffs on chips and critical minerals will have a “minimal impact on U.S. companies and consumers”.

On the other hand, experts from the Center on Global Energy Policy say that the tariff increase for batteries and critical minerals is “likely not substantial enough to undermine China’s competitive edge.” According to Mr. Moerenhout, China’s rate of innovation for batteries and critical minerals far surpasses that of the U.S.  As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog