Managing the Cooldown for EVs

Despite government and major OEM’s push for people to buy EVs, sales are crawling. EV startups are struggling, or left for dead.

The people have spoken: brand new EVs are way too expensive. The downturn in demand has OEMs rethinking their sales strategies and slowing down their rollouts for new EV models in 2024. Major OEMs such as the Detroit Big Three have been stretching out their EV timelines and instead, re-focusing on traditional, core vehicles such as gas-powered pickup trucks.

While the transition to electric vehicles is inevitable, OEMs realize that they can’t hurry demand, especially when the cost of a brand-new EV is higher than its gas-powered counterpart.

Large OEMs such as General Motors, Ford, and Chrysler can re-calibrate the way they do, but what about other OEM startups concentrating only on EVs, or tech companies that want to explore EVs?

The easy answer is they’re either sputtering or dead.

(Also Read: EVs Should be a Reality for All)

A Piece of the EV Pie

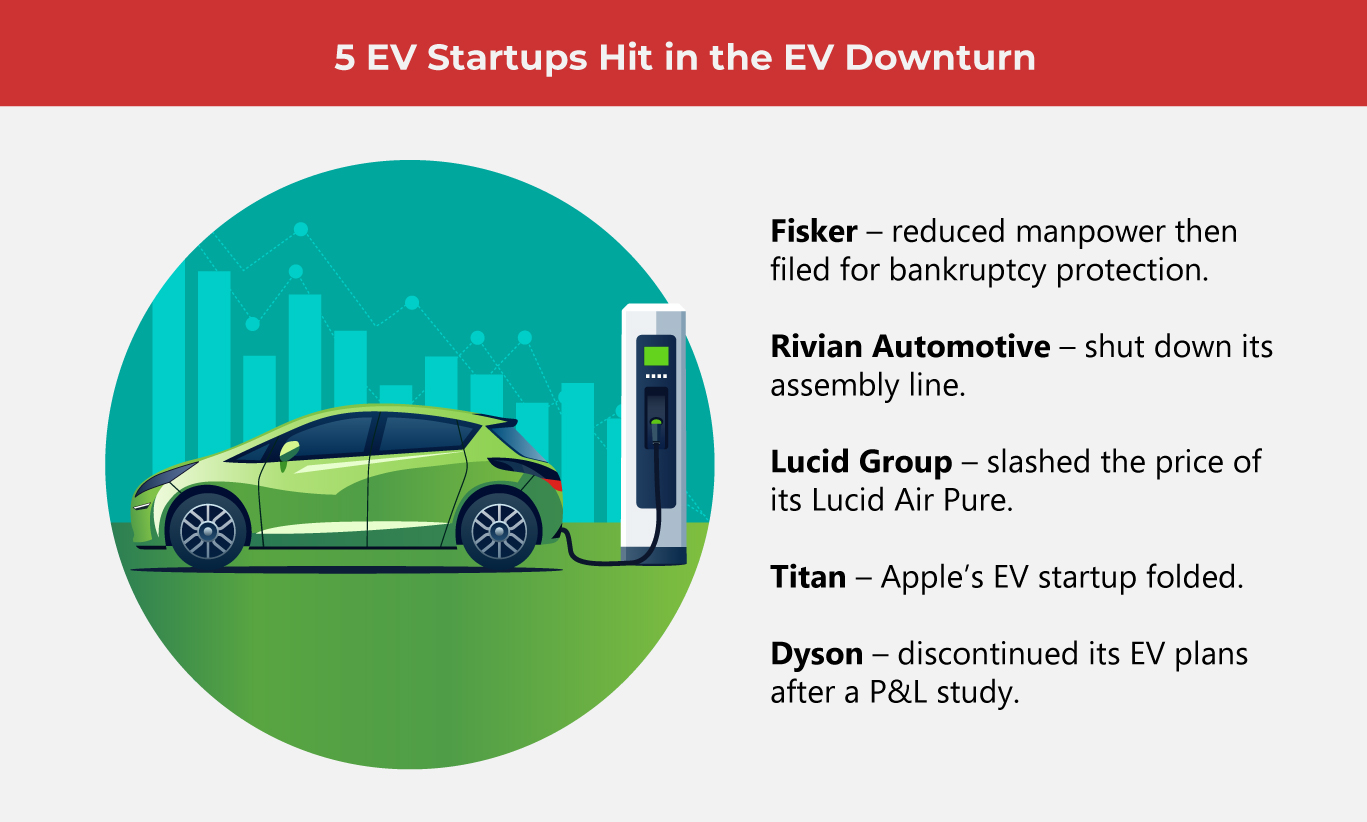

Tech companies such as Apple and Dyson, who are known for electronic products have tried to dip their expertise in the EV space and have failed. Experts point to funds drying out before any revenue has been made.

This seems to be the case across Titan, Apple’s EV startup, Dyson, and Fisker. It’s easy to see the intersection between electronic devices, appliances, and EVs, if only on a superficial level, and even easier to speculate why these tech titans who were not known for building vehicles became interested in taking a piece of the EV pie.

However, besides having an electric bond between their core products and EVs, manufacturing EVs is worlds different from the comfort zone of tech companies, who realized this the hard way: by losing billions and billions of dollars.

Reuters says that in June 2024, EV startup Fisker filed for bankruptcy protection. So far, Fisker is the latest EV startup that has folded. With so many other failed EV startups piling up on the EV horizon, Fisker’s steady decline was signaled by funding problems, slow sales, and supply chain challenges.

The company has had to reduce its workforce and pause investments, brokered partnerships with auto dealerships, and continuously lobbied for a major investment. These were not enough to keep the startup going.  Meanwhile, Rivian Automotive closed its assembly line early in 2024 to renovate its auto factory, but experienced a loss in shares in the first quarter of the year, falling short of earnings expectations.

Meanwhile, Rivian Automotive closed its assembly line early in 2024 to renovate its auto factory, but experienced a loss in shares in the first quarter of the year, falling short of earnings expectations.

The startup announced a second generation of EVs with new drive units, fewer parts, and upgraded system software in its efforts to entice buyers. Plus, Rivian introduced lower-ranged options for its existing units back in February.

Cash burn and supply chain problems hounded Rivian, and it attempted to resolve these issues by building some of its EV components in-house, and by re-negotiating their supply contracts.

The third startup to experience similar problems is Lucid, which told Reuters that it will reduce its workforce by 6% in May 2024. Similar to Fisker, Lucid also fell short of earnings expectations but probably did worse because Lucid had a streak of shortfall for six consecutive quarters.

The startup slashed the price of its flagship EV, the Lucid Air Pure, and added two free years of maintenance and charging allowance as incentives.

Asian EV Startups Are on Another Lane

Meanwhile, a price war between Asian EV startups has sparked and is spreading to overseas markets due to oversupply.

According to a report from Reuters, China’s National Development and Reform Commission (NDRC) expected more than 110 new EV models among a total of 150 new vehicles, inciting heavier competition.

Chinese OEMs are offering discounts to their EVs to compete with Japan. BYD and Denza have been slashing the prices off their units by 7-9% in April 2024.

The price war, which experts say is only getting started will add more fuel to the fire for American EV startups to contend with.  As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog