Shakeups and Hiccups in the Auto World

The roadmap for OEMS is showing more twists and turns on the horizon. Will this mean a downshift for the automotive industry?

The answer to this question is not one-size-fits-all. Rather, it could depend on which OEMs are asked.

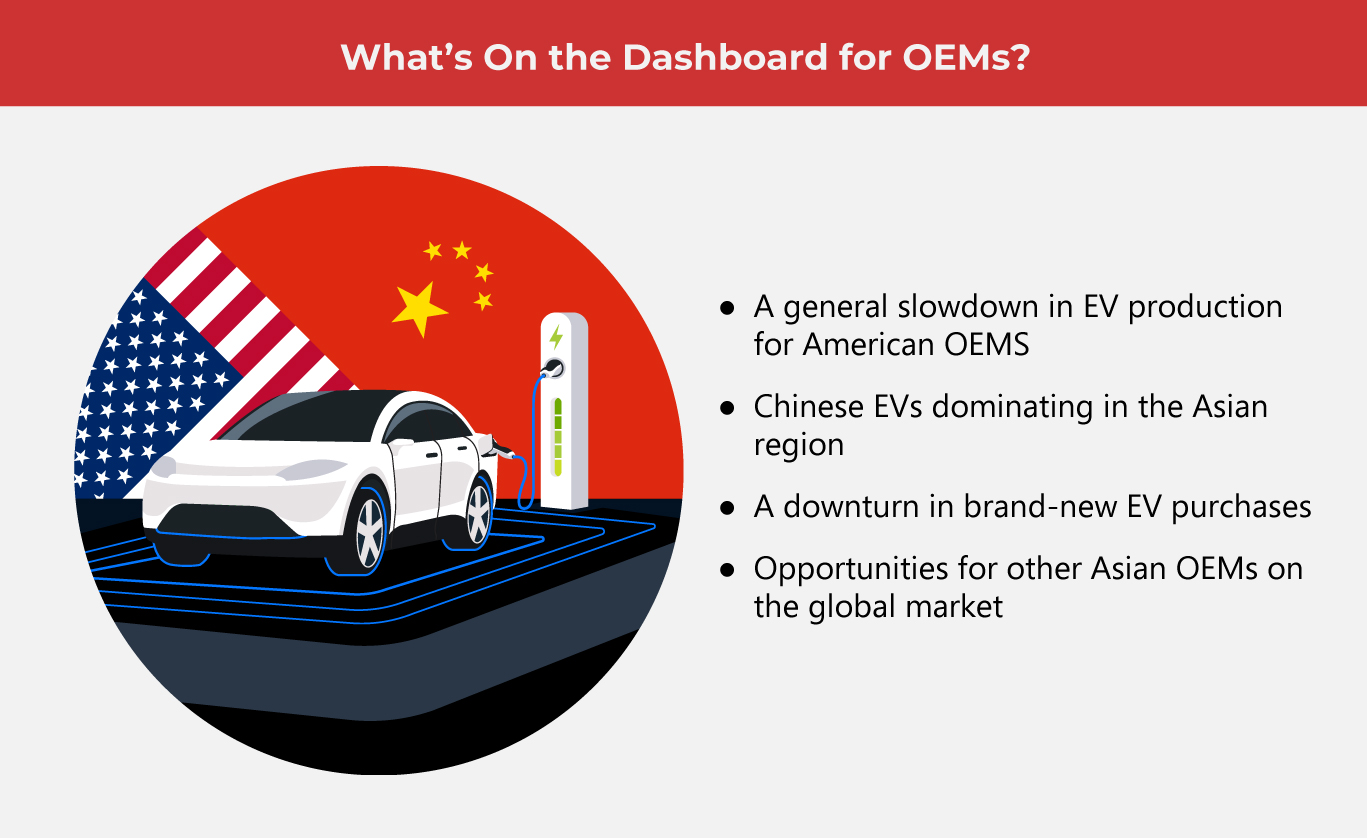

The Detroit Big Three Downshift

The outlook for American car-makers, specifically the “Detroit Big Three”: General Motors (GM), Ford, and Chrysler, is generally a little shaky. Financial analysts observe that these OEMS may be experiencing disruptions the auto industry has not seen in over a century.

If three of the largest names in the American automotive industry are given this outlook, then the road may be just as bumpy, if not more so, for smaller American auto-makers.

First, let’s look at why experts are saying this. John Murphy, a leading auto industry and financial analyst from the Bank of America shared his insights in his latest “Car Wars” study, citing hiccups for the Detroit Big Three.

Murphy says that these disruptions in the American auto industry will likely change what OEMs are selling and where they’re selling. The biggest takeaway from his study is this: pull out from the Chinese market.

It wasn’t long ago that the Chinese market was one of the largest for the Detroit Big Three. However, so much has drastically changed in the last year alone.

(Also Read: Yes, They’re Cheap, but Are They Good?)

Murphy cited the $100B loss for GM earlier in 2024 as a massive red flag. GM’s Q1 was not great in China, thanks to Chinese OEMs.

Chinese OEMs such as BYD, MG, and Xioami have rapidly overtaken American-made EVs in the country. Not only that but Chinese automakers are set on changing the EV landscape in other global markets, as well, including the United States and Europe.

(Also Read: Tensions Rise as U.S. Raises Tariffs)

In May 2024, U.S. President Joseph Biden raised tariffs on Chinese EVs, semiconductor components, and critical rare earth materials in the government’s efforts to protect and support American industries. Experts are not convinced that higher taxes for Chinese products alone would save the day.

From a consumer standpoint, the purchase of any kind of EV has slowed down. More consumers are opting not to buy newer models, never mind EVs because the cost of brand-new vehicles is too high, never mind the cost of brand-new EVs. Hardly anyone can afford them.

In response, some American OEMs are re-evaluating their strategies for EV rollouts and shifting to hybrids and plug-in hybrids. Many OEMs are stretching out their EV timelines, despite pressure to fully transition to rolling out full EVs before 2030 so more consumers can afford to buy new vehicles.

It isn’t only Chinese-made EVs that many American OEMs have to compete with. Domestic competition from Tesla has also become cutthroat. Tesla’s EVs dominate where many American OEMs try.

One key takeaway from Murphy’s study is that American OEMs should consider concentrating on their “core businesses” which include gas-powered pickup trucks, which sounds counter-intuitive when we think about the EV race.

Murphy’s study shows that the number of EVs expected to be released in 2025 to 2028 is 4% lower than what was projected in his 2023 Car Wars study.

While there may be a slowdown for EVs, Murphy says that there’s no turning back from transitioning to electric. However, he also says American OEMs need to devote substantial resources to reach the finish line.

Other factors such as the upcoming U.S. presidential elections contribute to the volatile and unpredictable U.S. auto market.

Asian OEMs are Just Warming Up

On the flip side, Chinese OEMs are running laps around the globe with more affordable EV alternatives.

Behind China, Asian OEMs from South Korea and Japan are racing to catch up. Meanwhile, new players from Indonesia and Thailand are warming up.

Frost and Sullivan’s 2024 ASEAN Automotive Growth Outlook shows three major trends defining the ASEAN automotive market: vehicle electrification, the automotive race between Indonesia and Thailand for dominance in the Southeast Asian region, and China challenging Japan and South Korea in the global market.

It appears as though where there may be a downturn in EV production in the U.S., the opposite may be true for their counterparts in Asia. Electrification is accelerating in Asia and appears to be better than steady.

EV sales in the Asian region have experienced significant growth in 2023, according to Frost and Sullivan. Supported by government policy on EVs, tax incentives, the number of affordable options from China, Japan, and South Korea, and most of all, shifting demands of the region’s market, the auto industry in Asia is doing better than fine.  As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog