Real Talk: Is Virtual Real Estate Real?

Virtual real estate sounds exactly what it is: land that exists on the internet. Just like its real-life counterpart, land on the internet costs real money to own.

Real estate has long been the playground of wealthy investors. Owning and selling property in highly desirable locations have made many portfolios valuable. Meanwhile, high rollers in the Metaverse are realizing that virtual land can indeed be just as valuable as the land on the other side of a computer monitor.

Many are saying it’s even easier to get into than actual real estate. All one needs is a digital crypto wallet and a large stack of money. Buying virtual real estate may be that easy for a rich guy who can afford a few NFTs, but it’s far from being simple for the rest of us who have yet to grasp what exactly the Multiverse is, let alone invest in it.

(Also read: Are We Ready For The Metaverse?)

Big Money In the Metaverse

With many global lifestyle and media brands such as Samsung, Disney, Balenciaga, and Gucci flocking over to the Metaverse and establishing their presence, the Metaverse can only expand as far as one’s imagination can. Many are eager to cash in on this virtual space that integrates real life as we know it with augmented reality (AR) by setting up shop there.

Virtual real estate is valuable because these are limited. Similar to actual land, these virtual properties (or, parcels as they’re called in the Metaverse) are finite, and their values are estimated depending on where they can be found in the Metaverse. The rule of thumb of real estate—“location, location, location”, still applies in virtual spaces. The more activity around a specific location in the Metaverse or the more famous people converge around it, the higher the value.

One buyer famously purchased virtual land at the whopping amount of $450,000 just to be Snoop Dogg’s neighbor. Some of the most expensive pieces of land in the Metaverse sell for millions of dollars. Companies like Nike invested in virtual land to build a virtual replica of their New York flagship store.

It would feel less complicated to comprehend if one would think of virtual land as actual land. Owners can do whatever they want with it. They may resell it, or they may build structures by hiring architects and 3D game developers to build their dream buildings. The cool part about it is that they can design these however way they choose to without worrying it will ever fall apart, laws of physics be damned.

Where in the Metaverse to invest in

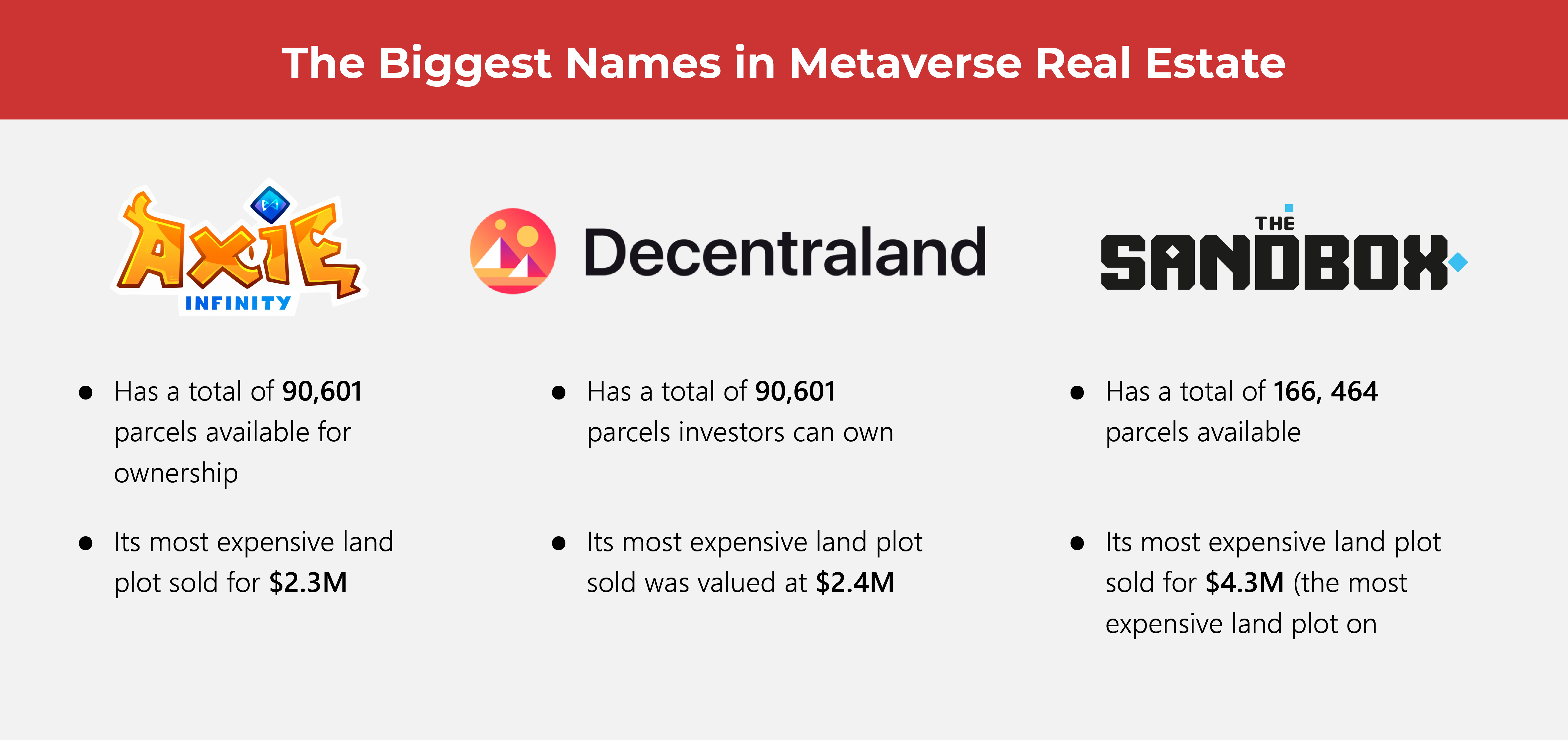

Decentraland

A platform that presents itself as an AR enthusiast’s playground, it offers Land NFTs they call “Land Tokens”. When a user purchases land tokens, it’s akin to buying property on which virtually anything may be built—a game, a virtual structure, their own virtual buildings. Virtual landowners may monetize their property any way they like, and they can even rent out their virtual land if they choose to. Those interested in buying virtual land here don’t even need prior knowledge about coding. The platform’s built-in engine helps users build whatever they want to on their land.

Axie Infinity

One doesn’t have to be into the Metaverse to have heard of Axie Infinity. The hugely popular game gained popularity by being the game one plays to earn. To earn a lot, one has to play the game as often as one can. In this game, players may participate by purchasing “Axies” via the cryptocurrency Ethereum. Players can earn real money by either selling Axies or converting the points earned from playing to real cash. Imagine playing Pokemon, but instead of catching pocket monsters, you catch cash.

The Sandbox

The Sandbox started as an ordinary mobile game that became a PC-based game. Essentially a world-building game, players are provided tools with which they may create universes and build whatever they like. Think of it as a game that’s similar to Minecraft or even Farmville. In 2018, it was acquired by a company called Animoca Brands and its title was used for the blockchain-based game as we know it today. Similar to Axie Infinity, users earn by playing the game.

Some Risks Involved

While investing in virtual land may sound easy and attractive (as long as you have the money to burn), it doesn’t come risk-free. Those who are seriously thinking of investing in virtual land must be willing to risk losing thousands of dollars.

In recent news, Yuga Labs, the company behind the NFT giant Bored Monkey found itself in a kerfuffle involving botched sales of pieces of virtual land for an upcoming game they developed called Otherside. Hyped to be “the biggest event in NFT history”, the launch caused a crash in the Ethereum network, causing many users to shell out thousands of dollars in transaction fees for NFT’s that cost about $500.

This, along with opportunists taking advantage of the metaverse chaos by putting up phishing scams to lure disappointed users hoping to get their money back into linking their virtual wallets to fraudulent sites has become a recipe for virtual disaster.

The Metaverse is like the Wild West of the virtual world, with everything up for grabs and crypto bros migrating in droves as though it were Gold Rush season. While it may be “easy” to invest in virtual land, keep in mind it’s just as easy to lose your investments, especially if one does not understand the environment and the rules under which it operates.

As one of the Top 19 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.