The EV Battery Game Changer Is Here

The technology behind SiC semiconductors is still relatively new, and OEMs are developing proprietary methods to incorporate the technology behind it into their EVs.

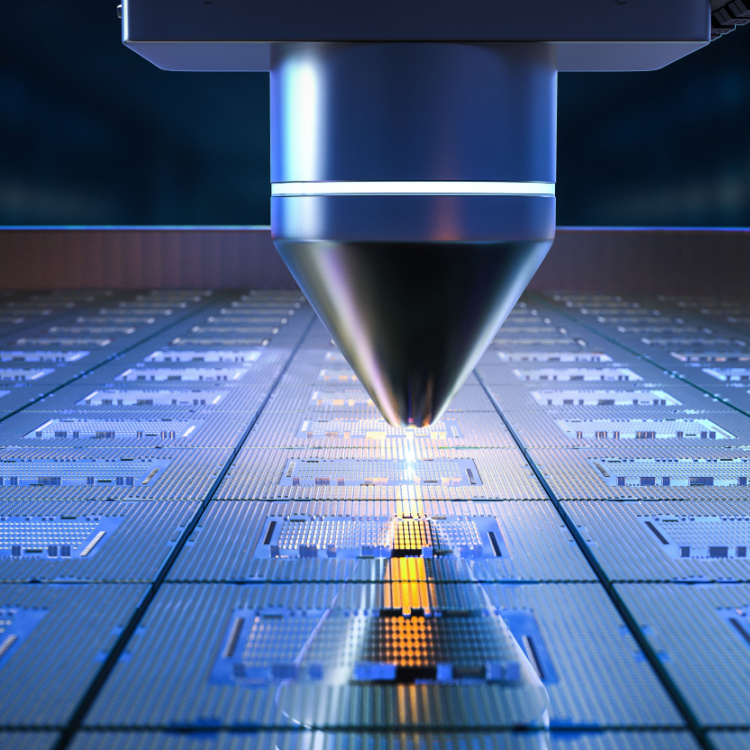

In March 2023, Denso Corporation announced that it has developed its first inverter with silicon carbide (SiC) semiconductors for the Lexus RZ, the company’s first battery electric vehicle (BEV).

(Also read: From Automakers to Chipmakers: Will DIY Save the OEMs?)

Denso is calling its SiC technology Revosic. Yole Group reports that the company is now utilizing it to “develop technologies for products ranging from wafers to semiconductor devices and modules such as power cards.” This is huge for the company and power electronics, OEM, and automotive industries as a whole.

Experts in the power electronics sector have been calling SiC semiconductors a “disruptive technology” as these have already changed the game for EV batteries.

But first, what are SiC semiconductors? What makes them such a game-changer?

SiC Semiconductors: the superior semiconductor

For automakers, replacing traditional silicon semiconductors with SiC semiconductors to make inverters for EVs means that the EVs are more powerful, and can run faster and more efficiently on lighter, sleeker bodies.

Power Electronics News breaks down what main properties silicon carbide has that makes it excellent for mechanical, chemical, and thermal applications, and among these are that it has a long lifetime, high thermal conductivity, excellent thermal shock resistance, low power and switching losses, and high energy efficiency.

Compared to traditional silicon semiconductors, SiC semiconductors have three times the bandwidth and three times the heat conductivity, are ten times stronger, and have ten times the switching speed of silicon.

Power electronics scientists and engineers have found that traditional silicon semiconductors have their limitations, especially when it comes to high-power applications. This is due to the energy gap found in silicon semiconductors. SiC semiconductors have a wider band gap width, allowing for better, more efficient transformation of power. A wider band gap width means that it allows devices to run at higher temperatures, voltages, and frequencies. SiC semiconductors are more reliable for these reasons.

The Rush for SiC Semiconductors

![]()

Market Research Future reports that the application for SiC semiconductors offers “significant growth prospects” for the power electronics industry, accelerating power semiconductor market revenue on a global scale. SiC semiconductors have ushered in a “gold rush” for investors, with many wanting to cash in and take advantage of how in-demand silicon carbide is. In terms of market share, Asia Pacific dominates, and the largest market for silicon carbide is the EV market.

Investment analysts such as Rashvindra Gill said that silicon carbide has “the potential to revolutionize multiple markets” and that “electric vehicles and the charging infrastructure are the megatrends driving the adoption of silicon carbide chips”. He says that the silicon carbide market is accelerating at a breakneck speed, as well as the demand for broader wide-bandgap materials.

To his point, many silicon carbide chip plants and factories are cropping up globally to keep up with the demand. A pioneer in SiC semiconductors, Wolfspeed constructed the world’s largest semiconductor chip plant in North Carolina in 2022. Wolfspeed has the first, largest, and only 20mm silicon carbide wafer manufacturing facility in Marcy, New York.

Meanwhile, Onsemi, a semiconductor company based in Phoenix, Arizona has also announced in the third quarter of 2022 plans to build a new silicon carbide materials factory in Hudson, New Hampshire.

Is the Future SiC?

What’s in store for the future of silicon carbide semiconductors?

Can SiC semiconductors save the chip shortage? KMPG Singapore reports that 24% of semiconductor executives interviewed believe that thanks to SiC semiconductors, the supply chain shortage is over. The boom is such that almost a quarter of those in the industry believe that SiC semiconductors have saved the chip shortage. In addition to this number, more than half (52%) feel that if the chip shortage has not yet ended, it will, by the middle of 2023.

Perhaps the most optimistic outlook of all is that 81% expect that company revenues will increase in 2023.

With automotive leading the market for SiC semiconductors, following closely behind are telecommunications, Internet of Things (IoT), cloud computing, and Artificial Intelligence.

KMPG says that the largest geopolitical concerns surrounding SiC semiconductor manufacturing are related to the nationalization of semiconductor technology for its potential impact on supply chains, talent acquisition, and access to government subsidies, citing the CHIPS Act in the United States and the proposed European Chip Act.

Deloitte reports that the global semiconductor industry is poised to “grow to US$1 trillion in revenues, doubling this decade”.

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog