This Chips War Is Just Getting Started

The trade war between China and the United States over rare minerals and chips is ramping up. It’s one powerful country versus another, and the rest of the world is caught up in it. The trade war between China and the United States over rare minerals and chips is ramping up. It’s one powerful country versus another, and the rest of the world is caught up in it.

In October 2022, the United States Department of Commerce implemented new export controls on advanced technology and semiconductors to China. This was done in the interest of “protecting the U.S.’s national security and foreign policy interests” and will “restrict the People’s Republic of China (PRC)’s ability to both purchase and manufacture certain high-end chips used in military applications.”

The move was condemned by China. A spokesperson from China’s Ministry of Commerce (MOFCOM) said that the move would damage U.S. export businesses in China and that the U.S. should “stop its wrongdoing and give fair treatment to companies all over the world, including China.”

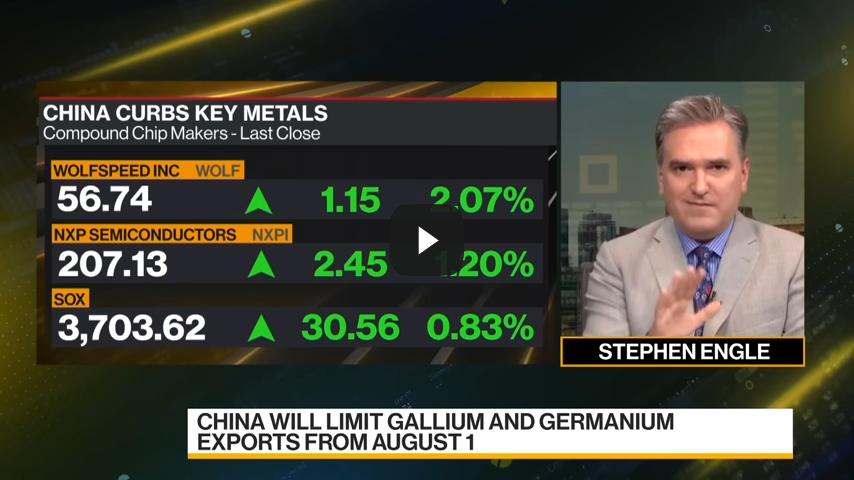

Did it come as a surprise when in July 2023, China announced its ban on exporting rare earth minerals “in the interest of national security”?

(Also Read: World Politics: An Important Link in the Supply Chain)

The relationship between the U.S. and China has always been fraught with tense “give-and-take” and “tit-for-tat” dynamics, and it’s becoming even more strained because of semiconductor chips.

China’s announcement in July regarding the ban was regarded internationally as being “abrupt”, and had companies rushing to secure supplies and contending with increased prices. In an interview with China Daily, Former Vice Commerce Minister Wei Jiangou said that “countries should brace for more” should the pressure on China from the U.S. continue. He also said that China’s move was a “well thought-out heavy punch” and that this is just the beginning.

The ban restricts companies in China from exporting gallium and germanium, two rare earth metals essential in the manufacture of many electronic devices.

Gallium, designated as a critical raw material by the European Union is used in the production of integrated circuits, LEDs, photovoltaic panels for solar panels, radar and communications devices, and satellites. On the other hand, germanium is used to make optical fibers, camera lenses, high-speed computer chips, plastics, and military-grade devices such as night-vision goggles.

Companies exporting these minerals are required to apply for licenses, stating the buyer and where the minerals will be used.

According to the European Commission, China comprises 80% of the world’s production of rare metals and minerals, so the country’s announcement has arrived at a critical time.

U.S. President Joe Biden issued an Executive Order in August 2023 restricting U.S. investments in Chinese technology. In a factsheet issued by the U.S. Department of Treasury Office of Public Affairs, companies from the U.S. are now prohibited from investing in “narrow sub-sets of three advanced technology areas” in China, as well as in Hong Kong and Macau.

The three restricted technology areas include semiconductors and microelectronics; quantum information technologies; and certain AI systems.

The factsheet says that this will “prevent US investments from helping accelerate the indigenization of these technologies in the PRC.”

In response to this, China has denounced the signing of the Executive Order. A Chinese Foreign Ministry spokesperson said that the move is “blatant economic coercion and tech bullying” and that it hurts both Chinese and U.S. business interests.

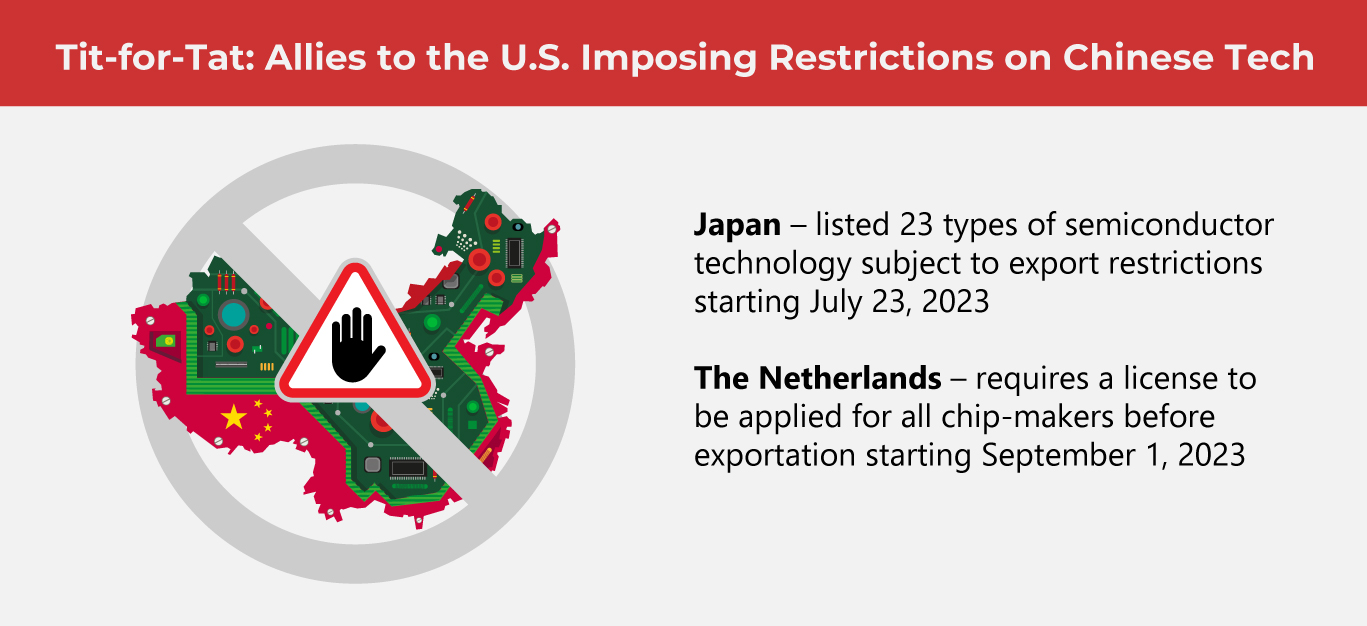

Meanwhile, the U.S. has urged other countries to form stricter restrictions for importing Chinese technology. Among the countries that have responded are Japan, the Netherlands, and Taiwan.

In late July 2023, Japan imposed its own microchip export ban, earning China’s ire. Though China was not named as a target in Japan’s restrictions, China still saw itself as the main target of this move. Spokesperson for the Chinese Foreign Ministry Nao Ming told reporters, “In disregard of China’s serious concerns, Japan insisted on making and implanting export control measures clearly aimed at China.”

Allied countries agreed with the U.S. stance on China in May at the G7 summit, in Hiroshima, stating the need to become less dependent on China for semiconductor technologies.

Technology and finance analysts are backing up the West when it comes to this stance, saying that although China is the largest supplier of rare metals for semiconductor manufacturing, it is not the only one. Alternative sources can always be explored. Areas such as Australia, Chile, the Democratic Republic of Congo, Indonesia, and Turkey are known reserves for minerals such as lithium, graphite, cobalt, magnesium, and copper.

A few more key takeaways from China’s banning of gallium and germanium come from senior analyst Agathe Demarais, global forecasting director at the Economist Intelligence Unit. In an article she wrote for the Financial Times, she enumerates four lessons to glean from the China ban, the last being that “Crises boost collaboration between allies.”

She’s not the only analyst encouraging allies band together to contend with a common adversary. Coordinating export controls is vital at this juncture. Whose move is it next?

As one of the Top 20 EMS companies in the world, IMI has over 40 years of experience in providing electronics manufacturing and technology solutions.

We are ready to support your business on a global scale.

Our proven technical expertise, worldwide reach, and vast experience in high-growth and emerging markets make us the ideal global manufacturing solutions partner.

Let's work together to build our future today.

Other Blog