Connect With Us

May 4, 2022, Laguna, Philippines — Integrated Micro-Electronics, Inc. (IMI) revenues grew to US$334 million in the first quarter of 2022, a 2% year-on-year growth despite continued increase in business backlog. Supply chain delays have hindered profitability but cost saving measures and continued collaboration with customers and suppliers mitigated the increased costs. Net loss for Q1 2022 narrowed to US$ 2.0 million compared to the previous quarter.

“As the entire industry has been dealing with the global component shortage for more than a year, IMI teams across the globe continue to embody the resilience and determination that has enabled us to rebound from similar macro-economic obstacles in the past,” said IMI CEO Arthur Tan. “Customer demand remains strong and new product development is still in high gear as evidenced by our revenue growth and strong pipeline performance despite the global supply chain issues in the past several quarters. The focus now is on driving profitability by collaborating with customers and improving supply chain efficiency as the component situation normalizes.”

Wholly-owned businesses ended the first quarter with US$258 million of revenues, 1% better than the same period last year. These operating sites have significantly improved quarter-on-quarter profitability with a net income of US$3.3 million in Q1 compared to a US$ 0.7 million loss the previous quarter. Meanwhile, subsidiaries VIA Optronics and STI started the year with US$ 76 million of revenues, a 4% improvement versus last year. However, with these business units having more specialized products in the automotive, aerospace and defense markets, extended supply lead times and limited opportunities to use alternative components have significantly affected margins. Covid-related shutdowns and transportation disruptions in Suzhou, China have also affected operations in VIA. In total, non-wholly owned subsidiaries ended the first quarter with a net loss of US$ 5.3 million.

“The recent lockdowns in China and intense geopolitical tension in Europe have created a new set of uncertainties in the global market. Along with the extended recovery of the electronics supply chain, IMI is still being challenged by multiple macroeconomic headwinds. However, globally, we have been managing these disruptions while taking advantage of opportunities to improve our operations. As more economies start to open up and the world returns to normalcy, the company remains committed to manufacturing excellence and accelerating our return to better profitability,” said IMI President Jerome Tan.

About IMI

Integrated Micro-Electronics, Inc. (IMI), the manufacturing arm of AC Industrial Technology Holdings, Inc., a wholly-owned subsidiary of Ayala Corporation, is among the leading global technology and manufacturing solutions expert in the world. IMI ranks 19th in the list of top EMS providers in the world by the Manufacturing Market Insider based on 2021 revenues. In the automotive market, it remains the 6th largest EMS provider in the world per New Venture Research.

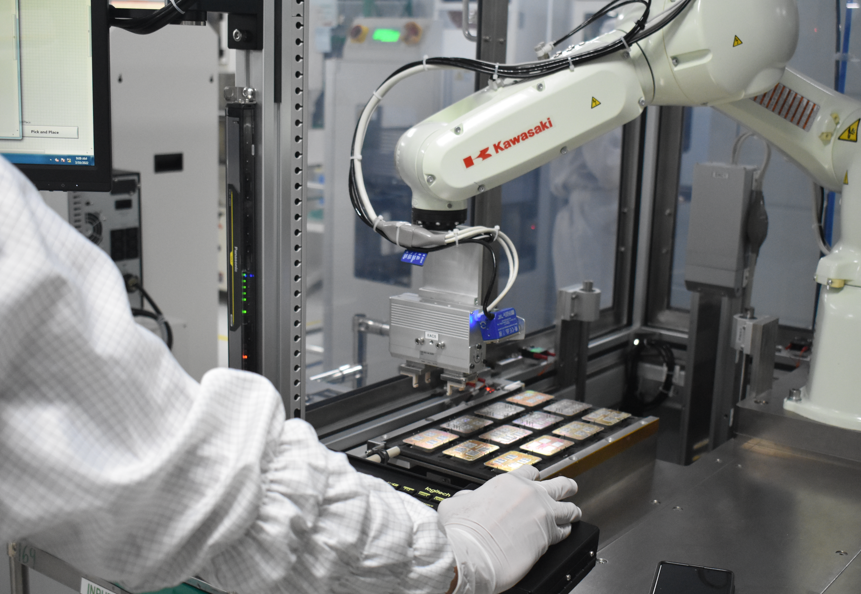

IMI specializes in highly reliable and quality electronics for long product life cycle segments such as automotive, industrial electronics and more recently, the aerospace market.

From its 21 manufacturing plants across ten different countries, IMI provides engineering, manufacturing, and support and fulfillment capabilities to diverse industries globally.

For more information, visit www.global-imi.com.

IMI will always be relevant, if not on the leading edge of the next big thing.